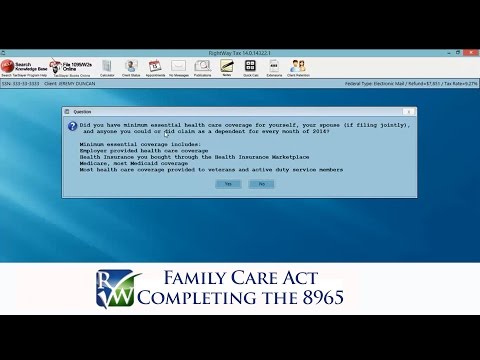

Divide this text into sentences and correct mistakes: 1. What we're going to talk about today is the Affordable Care Act. We just got software released and we've been receiving questions all summer about how is this going to be implemented, what's it gonna look like, how do we complete the form. So we just wanted to take a quick minute talk quickly, just a real quick recap on the Affordable Care Act and then what is it going to look like in the software and how to complete that form. 2. So we all know the Affordable Care Act is mandatory legislation that every taxpayer in the country is supposed to have minimum essential health care coverage. We're not going to go into detail is this what that means, but basically you're supposed to have health care qualifying health plan that gives you these minimal things. If you do not, then you are subject to an additional tax. 3. For 2014, the tax is the greater of 1% of your income net of specified deductions (so 1% of your income less a handful of things that you can take off of your income) or be $95 per adult plus forty seven fifty forty seven dollars and fifty cents per child up to a maximum of $285 per family. However, the penalty is capped at the average cost of a bronze level health plan. So if your 1% exceeds that $285, they're obviously going to go with that. But that is even capped at a certain level, so if you are a high-income person, it's not going to bleed you for your entire income amount. 4. So how do you calculate this penalty if you do not have the coverage? The first thing in the software when you're going through a basic return, it's...

Award-winning PDF software

Who needs instructions 8962 Form: What You Should Know

Mar 9, 2025 — To claim the credit, you must complete IRS form 8880 and include it with your tax return. Two key pieces of Federal Form 8880 Instructions — smart Tax Use Form 8880 to figure the amount, if any, of your retirement savings contributions credit Complete column (b) only if you are filing a joint return. Form 8880: Credit for Qualified Retirement Anyone who plans to claim the saver's credit on their taxes will need to complete Form 8880 and file it with their tax return. Not everyone is eligible for this Mar 9, 2025 — To claim the credit, you must complete IRS form 8880 and include it with your tax return. Two key pieces of Federal Form 8880 Instructions — smart Tax Use Form 8880 to figure the amount, if any, of your retirement savings contributions credit Complete column (b) only when filing a joint return. Form 8710: Retirement Savings Contributions Credit Mar 9, 2025 — To claim the credit, use IRS form 8710. Form 8710 will calculate the amount of your qualified retirement contribution for the year. Mar 9, 2025 — To claim the credit, use IRS form 8710. Form 8539: Elective Deferrals Mar 9, 2025 — To claim the credit, use Form 8539. Form 8539 is similar to Form 8880, but only allows you to claim your elective deferrals for the year. Use the online form to figure Mar 9, 2025 — To claim the credit, use Form 8539. Form 942: Required Section 401(k) Excess Contributions to Your Taxes Mar 9, 2025 — To claim the credit, use Form 942, as well as Form 2555. Get Form 942 with your 1040. Use Schedule SE to figure how much you make in the 1099-B — Nonqualified Dividends & Interest of Qualified Individual Mar 9, 2025 — To claim the credit, use IRS form 942, Form 9410, and Schedule SE. The form will allow you to claim your nonqualified dividends and interest earned for the year. This form should be Mar 9, 2025 — To claim the credit, use IRS form 942, Form 9410, and Schedule SE.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions 8962, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions 8962 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions 8962 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions 8962 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who needs Form Instructions 8962